When Ren� Redzepi, head chef of the world�s second-best restaurant Noma, launched a pop-up in…

Inside Australia’s almond industry

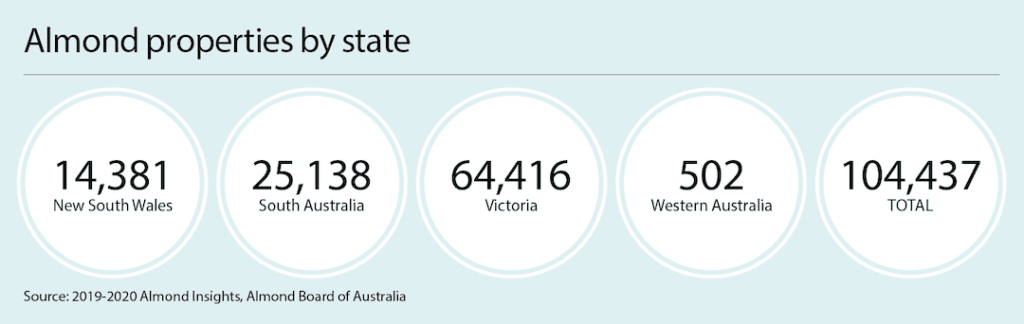

Driven by rising global demand for plant-based healthy foods such as nuts and nut products, Australia has become a world leader in almond production. There are now more than 15.4 million almond trees planted across four states, and the relentless growth of the almond industry shows no sign of slowing down.

While managed investment schemes kicked off the almond boom in north-west Victoria from 2003 to 2008, expansion in the NSW Riverina during the past decade means growers in that region now account for 35 per cent of trees.

Nutting it out

Fourth-generation farmer James Callipari was among the early wave of almond producers in the Griffith area.

As fruit and vegetable growers, his family began looking for less perishable alternative crops, and James joined a group of farmers on a visit to look at almonds in South Australia in the mid-2000s.

�The vegetable market was at the stage where either you had to get a lot bigger to become profitable, or you had to get out. The almond industry attracted us because the product itself was more shelf stable � it wasn�t necessary to pick it today and sell it tomorrow. There�s a bit more flexibility.�

James Callipari, NSW Almond Farmer

At the time the Riverina was firmly in the grip of the Millennium drought, and water was both scarce and expensive.

The Calliparis moved to another property equipped with subsurface drip irrigation, which they were able to use for almonds. They planted the first trees in 2006, and by 2017 had filled 220ha of the 275ha property with five varieties of almond trees. Half are Nonpareil � the most popular snacking variety � and the rest are pollinating varieties: Carmel, Price, Monterey and Wood Colony.

It takes three years for almond trees to bear their first crop and another four years to reach full production of about 9.2 tonnes per hectare of nuts in shell; about 3.2 tonnes of that is almond kernels, while the rest is hulls and shells that are used for cattle feed, compost, mulch and biochar.

The industry average for water consumption by mature almond trees is 11-14 megalitres per hectare, similar to other high-value crops such as citrus. James says he�s been able to keep it to less than 10ML/ha most years thanks to the higher water holding capacity of his soils, and aided by tree sensors and irrigation line sensors. The industry funds ongoing research into methods of further improving water use efficiency.

As well as almonds, the Calliparis grow Valencia and Navel oranges, wheat, and recently finished harvesting their first rice crop in three years. Like many farmers, they have a combination of high security and general security water entitlements.

Supply and demand

James says a combination of factors has encouraged more Riverina farmers to plant almonds. They include consistent high prices, increasing domestic and global demand, the high level of mechanisation, access to multiple sources of water for irrigation and the opening of the $25 million Almondco processing plant at Hanwood in 2017.

Until then, Almondco growers had to truck their nuts 580km to be dehulled and deshelled at Lyrup, near Renmark, in the Riverland region of South Australia.

�There�s a significant saving to have it 20 minutes� drive instead of six hours,� James says. �Having it on our doorstep is really good for the industry.�

With 33 per cent of Riverina plantings yet to bear fruit and more trees going into the ground each year, Almondco has already doubled its shifts and plans to expand the Hanwood plant in the next two years.

Almondco managing director Brenton Woolston says the facility�s first stage was based on forecast production from existing plantings of the cooperative�s more than 20 members in the region.

�Since we made the investment in primary processing infrastructure in the region, there�s been a lot more plantings in the area,� he says. �Having a processing site in the Riverina certainly stimulated our existing growers to plant more, and some new growers to get into almonds. We haven�t encouraged or advertised that almonds should be planted � this has been a natural economic progression.�

Almondco is supplied by more than 150 Australian growers and has members in NSW, South Australia, Victoria and Western Australia.

Water woes

Mention the words almond farms, corporate farms and managed investment schemes in some circles, and you�ll cop an earful.

Dairy farmers in particular blame the development of corporate almond farms for pushing the price of both permanent and temporary irrigation water beyond their reach and forcing them out of business.

Environmentalists criticise almond farms for increasing the volume of water extracted from already stressed river systems in the Murray-Darling Basin.

And many mum and dad investors and suppliers are still nursing financial wounds from the collapse of managed investment schemes, such as Timbercorp. One of the biggest schemes � it developed the world�s second largest almond grove � Timbercorp was the first to go belly up, owing $980 million when administrators were appointed in 2009.

Yet it was the almond industry�s peak body, the Almond Board of Australia (ABA), that called for an Australian Competition and Consumer Commission inquiry into water markets in the Murray-Darling Basin as water prices surged during severe drought in 2019.

The ABA also appealed for a freeze on new water use licences by NSW, Victoria and South Australian governments, pending a review of the system�s capacity to deliver water to support more development, �without adverse third-party or environmental impact�.

NSW Farmers has called for a halt in new irrigation development approvals downstream of the Barmah Choke until an audit is carried out to show that the water can be delivered without third party impacts.

Australian Nut Industry Council chair Brendan Sidhu, a former ABA chair, says the only impediments to the future expansion of the almond industry are climate � almonds prefer a Mediterranean climate that provides chill hours during winter to stimulate bud break and flowering � and access to suitable land and water.

�We all understand (water) is a finite resource, so we have to use it wisely,� he says. �What�s really worrying me is the annual crops are now outnumbered by permanent plantings. New South Wales is still going hell for leather, which is a bit of a worry, because come the next Millennium drought or a big drought like that, it�s going to be horrendous.�

Scaling up production

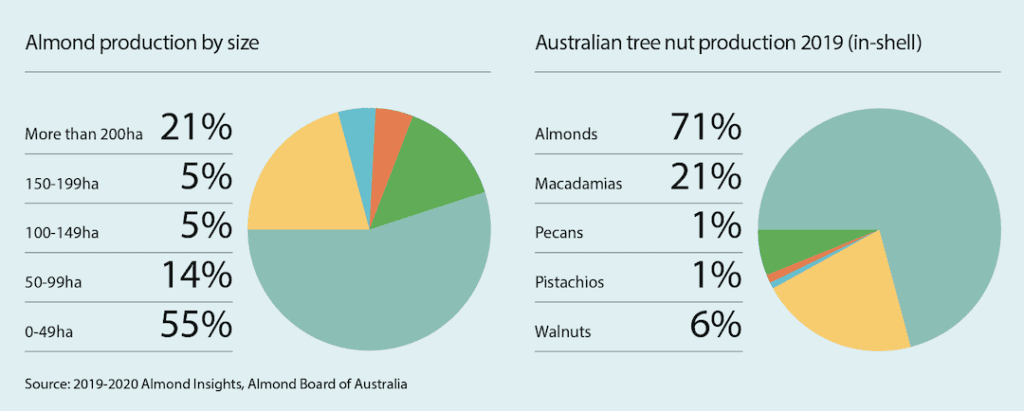

Most almond producers have traditionally been family-owned smaller farms in areas that began as soldier settlements. Indeed, a recent report from the Almond Board of Australia (ABA) estimates that 55 per cent of all almond properties are less than 49ha in size.

According to the ABA, the total area planted to almonds grew from 3,546ha in 2000 to 26,589ha in 2010 and 53,014ha in 2019. More than half the new plantings between 2015 and 2020 were in NSW.

Production is set to increase from this year�s record 123,000 tonnes � with a farm gate value of almost $1 billion � to 180,000 tonnes in 2025-26. Depending on future plantings, it may even reach 200,000 tonnes by 2030. The volume of exports increased 25.7 per cent to 76,556 tonnes in 2019-20; China and Hong Kong took more than half after imposing tariffs on almonds from the US.

And while corporate farms have been responsible in the past for much of the heavy lifting � many of them processing and marketing large volumes from their own groves � Brenton says that�s not the case in new Riverina developments.

�What we�ve seen is private family-owned orchards at scale,� he says. �Riverina growers don�t seem to mess around with 20 acres or 30 acres. If they�re going to make that investment, they generally get into it in a lot bigger way than we�re used to in other growing regions.�

California continues to produce 80 per cent of the world�s almonds, but in his annual report ABA chair Peter Hayes says the growing demand for Australian almonds has been a success story for many years.

�And 2019-20 is no different, with consumers recognising their health benefits, enjoying almonds in many new manufactured products, and moving to plant-based diets as concerns over animal welfare gain traction,� Peter says.