Covering your carbon credit risk

Buyers of carbon credits are taking out insurance to cover their environmental risk. Carbon farming consultants are also seeking insurance to cover any potential liabilities. Should farmers be doing the same to cover risks associated with selling carbon credits?

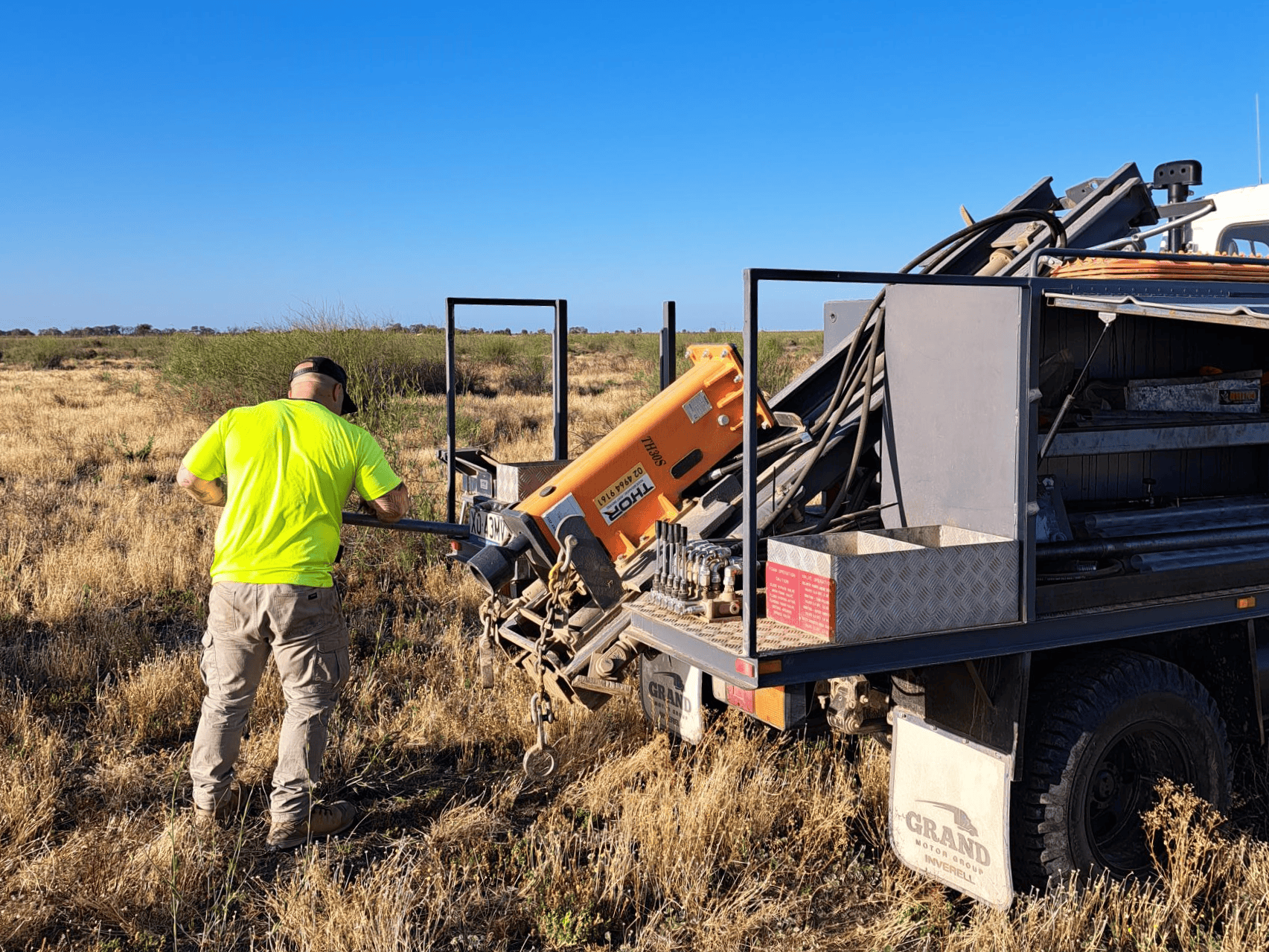

Carbon farming is climbing the ranks as a greenhouse emissions reduction measure as more farmers sign up to sell carbon credits through the retaining and improving of vegetation or increasingly through the building of carbon levels in the soil.

That climb is partly due to the introduction of a new soil carbon methodology in 2021 that enabled farmers to start selling Australian Carbon Credit Units (ACCUs) to companies seeking to abate greenhouse gas emissions.

Buyers are lining up to purchase them and many now have access to insurance policies to provide protection against potential risks to the non-delivery of environmental obligations due to natural disasters, data fraud or incorrect accounting practices.

Leading environmental insurance specialist, Anthony Saunders, says environmental consultants are also seeking public liability and professional indemnity insurance in the case of a carbon farming project that fails to deliver.

Anthony has specialised in environmental liability since 2006 following involvement in a fuel station groundwater contamination case at Coramba in the north coast region. He started the EnviroSure® brand under a Lloyd’s Insurance banner and is now principal of Sydney-based brokerage Insurance Choice.

“It is the most complicated area of insurance. It took me years of research and preparation to develop sustainable insurance options for liabilities associated with environmental risk,” Anthony said.

Anthony said he has focussed on providing professional indemnity insurance for environmental auditors, engineers and consultants.

“That includes people providing advice to farmers on carbon farming and the selling of carbon credits. They have an insurance policy to cover their liability in the event of an error that has caused the farmer a financial loss.”

“Then it goes back over to the farmer. Does the farmer have cover to protect from them from their loss or claim and transfer liability back to the advisor.”

While Anthony is based in Sydney, he does have a good understanding of agriculture and regional communities through family being involved in farming. He has also supported farmers and the Great Artesian Basin Association with concerns about the environmental risk of CSG mining by confirming that it is a deliberate process that creates a certain environmental externality and is therefore uninsurable.

Covering risk

Anthony is now extending his environmental risk expertise to farmers after being inspired by learnings through his NSW Farmers membership and stories in The Farmer magazine about environmental liability concerns.

“My advice is to first talk to your insurance broker or agent about whether a carbon credit contract you are potentially entering into is insurable.”

“If that broker or agent is unsure, then they should get in contact with an insurance expert in the field to get assessment of the risk for their client.”

“The farmer does have a potential liability in the event of not being able to provide the carbon credits to the buyer due to a climatic event or accounting mistake.”

Anthony said farmers should investigate the risks and investment associated with supplying and selling carbon credits before entering into a contract.

“That includes the examining the worst-case scenario that could never happen such as a natural disaster that prevents carbon being sequestered for a couple of years.”

“The farmer needs to decide whether they can weather that storm financially, and that should depend on the potential carbon credit income losses. If the losses are significant, the farmer should sit down with an insurance broker to develop a viable insurance policy to cover the risk.”

“In most cases, the buyer would have insurance to cover the liability of not being able to meet environmental obligations.”

Anthony does not deal directly with farmers in relation to environmental risk policies but does urge farmers to examine their potential exposure before entering into a carbon credit agreement.

“You could be mortgaging your life away with hope that the future is going to be paying of all the costs of carbon farming and making profit.”

To find out more, contact Anthony at EnviroSure – visit envirosure.com.au or call 1300 799 950 and ask for EnviroSure.