Scientists are concerned that the current model for stopping biosecurity threats from entering Australia is…

NSW Farmers oppose proposed biosecurity levy

Industry leaders argue the new levy is unfair double taxation, highlighting the substantial existing contributions of farmers to biosecurity efforts.

Farmers are once again urging the federal government to halt its proposed biosecurity levy that would place additional financial burdens on Australia’s farmers, who already contribute significantly to the nation’s biosecurity funding.

Federal Agriculture Minister Murray Watt will introduce a ‘Biosecurity Levy,’ aimed at increasing charges for farmers under the guise of enhancing biosecurity protections from 1 July 2024.

This proposal was met with substantial resistance, as it was perceived as an unjust double taxation on farmers, who already provided a considerable portion of biosecurity funding.

NSW Farmers was rallying against the proposed biosecurity levy, which would be an extra burden on farmers, already heavily invested in the nation’s biosecurity through significant contributions.

Ash Cooper, NSW Farmers Agricultural Industries Policy Director, said the proposal was an unjust double taxation.

“There’s no doubt farmers are already paying their fair share and now the government wants even more. Farmers should not be subjected to an extra levy for biosecurity system funding,” Mr Cooper said.

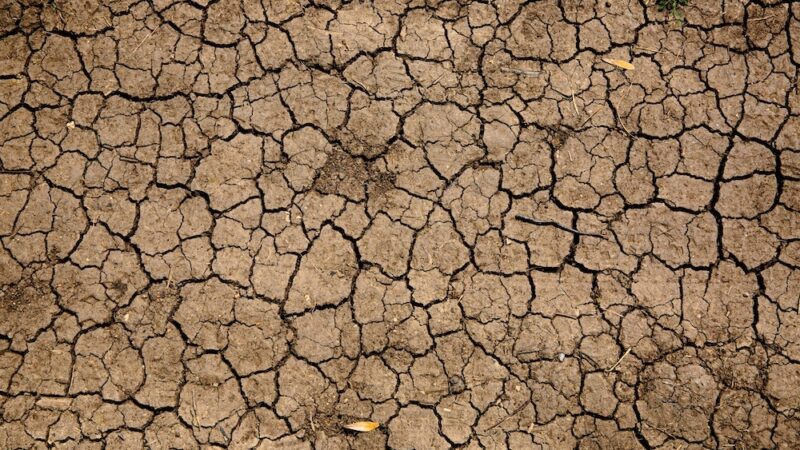

Farmers not only contributed hefty sums towards biosecurity levies but also incured billions in annual costs combatting on-farm biosecurity threats such as weeds, pests, and diseases, Mr Cooper said.

“In November 2023, the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) released a report saying Australian farmers are spending $3.8 billion a year to control vertebrate pests and weeds and they’re suffering production losses of $1.5 billion. So that’s a total of $5.3 billion a year in production and management loss,” he said.

“The responsibility for biosecurity lies with all of us, so it’s unjust to burden farmers with these costs, especially considering their substantial efforts in managing these threats. Costs vary across the nation, and this also depends on the type of pests and weeds involved but, according to ABARES, it is NSW that is hardest hit.”

A recent ABARES study revealed NSW accounted for the largest share of estimated costs, at 26 per cent of the total $5.3 billion. NSW Farmers was still awaiting specifics on how the latest amendments to the proposed levy would address concerns highlighted by the agriculture sector since last May.

Mr Cooper raised concerns about the absence of details on implementing measures like levying a product only once in its lifecycle, should the levy be enacted. He also criticised the proposal to adjust the levy based on the gross production value, which could lead to unfair financial demands on different commodities.

“Since the government first announced the biosecurity protection levy, farmers have let them know we are already contributing significant levy to the management of pests and weeds,” Mr Cooper said.

“Farmers are also contributing significant levy dollars towards research development, as well as extension and funding of biosecurity preparedness response and also our ability to respond if there’s an incursion of an exotic animal disease or plant pest.

“In the plant space, some farmers are already contributing to response efforts to the Varroa mite, so those industries who are signatories to the emergency plant pest levy mechanism are now going to take about five years to pay the industry contributions to the Varroa mite response. So, this means they must pay that money back to the government.

“If we are to introduce a biosecurity tax, it should be levied on individuals and products entering Australia, rather than unfairly targeting farmers already contributing towards biosecurity efforts.”

With the levy’s implementation date looming on 1 July of this year, Mr Cooper cautioned that it’s crucial for the Federal Government to heed NSW Farmers recommendations promptly.

He has also pointed out the unfairness of imposing additional expenses on farmers for biosecurity measures, while no levy was being applied to shipping containers, which were a significant risk to bringing vertebrate pests and weeds into Australia.

“Although we support the government’s intention to protect our country from threats like foot and mouth disease, this approach is misguided,” Mr Cooper said.

Mr. Cooper called for a collaborative effort to refine the biosecurity levy bill, reflecting on a Senate committee report that acknowledged the sector’s concerns. He stressed the importance of addressing these issues through further amendments to ensure the bill’s progression benefits the industry’s long-term prosperity and biosecurity.

NSW Farmers recommended there must be biosecurity funding models that accounted for imbalances and existing cost recovery arrangements.

“Most importantly, the biosecurity risk creators need to have shared cost responsibility, so we are calling for a charge on imported shipping containers. We also want to ensure we have increased charges for incoming passengers and produce entering Australia that contribute to the costs the proposed levy seeks to cover. Biosecurity is a responsibility that must be shared and not solely carried by farmers,” Mr Cooper said.

If you enjoyed this piece on the proposed biosecurity levy, you may like to read about the current epidemic of weeds and pests in NSW.