From Crop Fields to Close Calls

The agricultural industry is a turbulent environment, characterised by unexpected challenges. With over 239,0001 Australian�s working in the agriculture industry, safeguarding the future of Australian farmers and their families with life insurance has never been more valuable

While terms such as �crop rotation�, �irrigation�, and �agriculture� frequent conversations amongst Australian farmers, �life insurance� is typically a less discussed topic.

Farmers are no strangers to the unpredictable challenges which threaten the agriculture industry, including fluctuating market prices, livestock illness, crop-failure, and weather-related risks. However, even the most prepared farmers cannot anticipate everything.

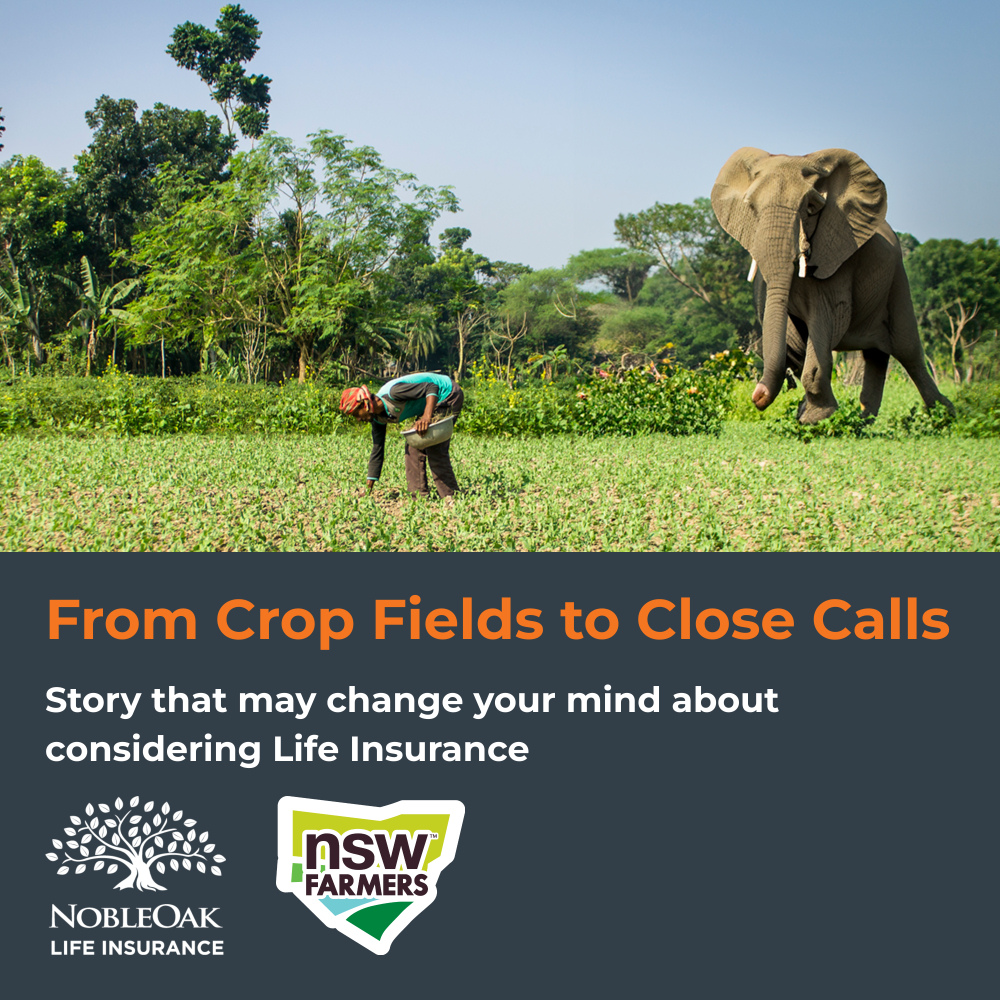

Thinking about this in a real-life situation, what seems a farfetched story, was actually the frightening reality for Indian farmer, Thimmaiah, who had a narrow escape with a wild elephant in March 2024. The areca farmer was working early in the Kesaguli Village of Karnataka, when a wild elephant identified by locals as �Karadi�, charged at him. Thimmaiah was chased as he ran to safety towards a farmhouse, where CCTV footage shows him hiding under a car to evade being in range of the elephants tusks. Not something we hear everyday here in Australia!

Whether it be being chased by wildlife, or losing crops at the hands of them, life insurance can act as a security blanket against unforeseen circumstances and help to provide financial assistance to Australians during challenging times. Knowing you and your loved ones can be protected through life insurance if the unexpected occurs � including charging animals – can give you that peace of mind so you can spend time focusing on what�s truly important to you.

With 68%2 of Australians employed within the agriculture industry working full time, there is a great dependence on their farms for their livelihood. That is why having precautions in place to help pay off debts, cover expenses, and protect loved ones from financial hardship cannot be underestimated.

In line with the saying �the early bird catches the worm�, there�s no time like the present, consider life insurance for you and your family.

NobleOak Life Insurance premiums are more than 20% lower on average~ compared to other direct life insurers, this includes a 10% lifetime discount on life cover* for NSWFA members, sowing the seed to safeguard your future is more accessible than ever with NobleOak.

For more information on how to reduce financial uncertainty in your life, it only takes a few minutes to get a quote for life insurance online or over the phone by calling NobleOak on 1300 108 490.

Disclaimer:

In connection with NobleOak�s involvement with your Association�s member benefits programme. NobleOak Life Limited and its related entities pay a marketing fee to your association. Part of the fee is an ongoing amount equivalent to a percentage of premium on cover purchased by NSW Farmers� members under the program. This is not an additional charge to you.

Important information � The Target Market Determination for NobleOak�s Premium Life Direct insurance is available on our website www.nobleoak.com.au/target-market-determination

*Discount � NSWFA members are entitled to a 10% discount (which remains for the life of the cover) on NobleOak�s standard premium rates for its term life cover.

The offer(s) are available for new customers only and can be used only once. Not able to be used in conjunction with another advertised offer.

~NobleOak�s Premium Life Direct Life Insurance premiums are more than 20 percent lower than the average premium of 15 comparable Direct Insurance products. Our analysis is based on premium rates available as at 30th September 2023, calculated by Plan For Life for Term Life Insurance cover offered directly through insurers (without personal financial advice). Premiums currently available for members include a 10% discount to our standard Premium Life Direct premium rates, and this discount has been factored into the calculations. The average savings quoted are applicable to males and females, smoker and non-smoker, from ages 30 to 60, with sum insured from $100,000 to $1.5m. Plan For Life is one of the leading independent suppliers of Australian Life Insurance and Managed Funds market information, relied upon for over 20 years by the leading life offices, analysts, dealer groups and government bodies.

Legal statements. Premium Life Direct is issued by NobleOak Life Limited ABN 85 087 648 708 AFSL No. 247302. Address: 44 Market Street, Sydney NSW 2000. Phone: 1300 108 490. Email: [email protected]. Cover is available to Australian residents and is subject to acceptance of the application and the terms and conditions set out in the Premium Life Direct Product Disclosure Statement (PDS). This information is of a general nature only and does not take into consideration your individual circumstances, objectives, financial situation or needs. Before you purchase an Insurance product, you should carefully consider the PDS to decide if it is right for you. The PDS is available by calling NobleOak on 1300 108 490 or from www.nobleoak.com.au. Clients should not cancel any existing Life Insurance policy until they have been informed in writing that their replacement cover is in place. NobleOak cannot provide you with personal advice, but our staff may provide general information about NobleOak Life Insurance. By supplying your contact details, you are consenting to be contacted by NobleOak, in accordance with NobleOak�s Privacy Policy.

Source:

[1] https://www.agriculture.gov.au/about/news/census-snapshot-shows-changes-agricultural-workforce

2 https://www.agriculture.gov.au/about/news/census-snapshot-shows-changes-agricultural-workforce