Garry Kadwell, a fourth-generation potato farmer from Crookwell in the NSW Southern Tablelands, has been…

ACCC inquiry into perishables

The three-month ACCC inquiry into perishables focused on supply chains for perishable agricultural goods, such as meat, eggs, seafood, dairy and horticultural products.

In a statement issued after the inquiry report�s release in December 2020, ACCC Deputy Chair Mick Keogh says the dominance of markets for agricultural goods by few processors or wholesalers, and even fewer major retailers, made farmers especially vulnerable.

�In addition, the more perishable a product is, the weaker the farmer�s bargaining power often is,� he says.

That vulnerability was highlighted during the submissions process. Only 35 of the more than 80 written and oral submissions have been made public � the rest are being kept confidential to protect farmers and suppliers from being punished for speaking out.

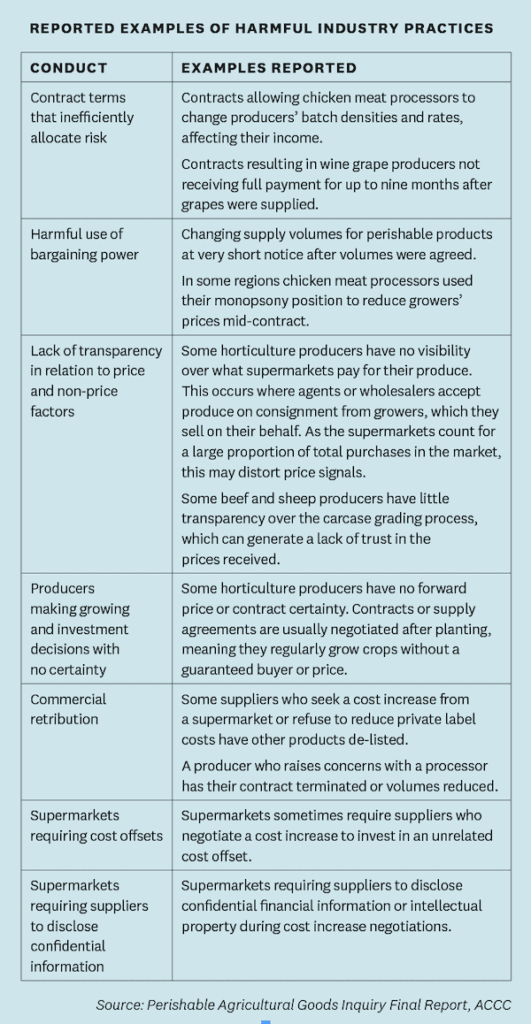

The inquiry heard numerous examples of unfair practices, including one-sided contracts, commercial retribution, inequitable allocation of risk, arbitrary price cuts and a lack of price transparency.

Some of the most serious claims were from the chicken meat and horticulture sectors and the ACCC will continue to investigate potential unfair contracts and reported breaches of the Horticulture Code. The ACCC�s dedicated agriculture unit also will do more to explain how farmers and suppliers can use the new small business collective bargaining process.

NSW Farmers� President James Jackson welcomed the ACCC inquiry into perishables and said that the findings address the �symptoms of the disease, not the disease itself�.

James says the systemic failure of competition in fresh food supply chains is hindering the investment needed to ensure farm gate production reaches its $100 billion target by 2030.

�What�s needed is for our federal politicians to have the will to improve competition laws and make the supply chain accountable to the farm gate,� he says.

�There needs to be consequences, substantial fines that hurt, for making a mess of it. There are jail terms for breaking workplace health and safety laws, but competition laws are seen as a business cost. They�re not seen as a problem or a serious crime. And they are because they are causing grief right through the economy. Really, it�s no different to wage theft.�

processors or wholesalers, and even fewer major retailers, made farmers especially vulnerable.

In its submission to the inquiry, NSW Farmers proposed consumer law be rewritten to include the option of forced divestiture to limit the market share held by a single business.

�This would break up some of those vertically integrated and horizontally integrated organisations that essentially cost shift and put competitors out of business,� James says.

It�s not only the major retailers, such as Coles and Woolworths, that are in NSW Farmers� sights. Consolidation in the meat processing sector has left farmers at the mercy of a handful of companies.

A decade ago there were nine chicken meat processing plants run by six different operators in NSW. There are now four plants � near Sydney, Newcastle, Tamworth and Griffith � run by just two operators, Baiada Poultry and Cordina Farms.

The number of chicken meat growers also has also dropped, from 265 in 2014 to about 190 in 2020, many of them squeezed out by the withdrawal of processors from some regions. The July-August edition of The Farmer featured the Partridge and Courtney families whose contracts were cut after Inghams decided it was too expensive to freight birds from the Northern Rivers to its Brisbane plant.

A similar concentration of processors in some regions has occurred in the dairy, beef and sheep meat sectors, while the dominance of large vertically-integrated operators that both produce and process pork meat make negotiation difficult for smaller producers.

The perishability of seafood and fruit and vegetables puts those producers at a significant disadvantage in negotiations with supermarkets.

National Farmers� Federation Chief Executive Officer Tony Mahar called for the Federal Government to urgently implement all recommendations from the ACCC inquiry.

�What the ACCC have found is not surprising but deeply concerning,� he says. �I have heard countless examples from our horticulture growers of buyers using short notice cancellations to exploit growers. Once the farmer has picked and packed the produce, they get a phone call from the supplier stating they are cancelling the order; in the same breath they make a �new� order for the same produce at 30 to 40 per cent discount. This is outrageous.�

While collective bargaining, through marketing companies, has helped NSW oyster farmers secure higher prices in the past three to five years, it�s not the answer for all sectors.

NSW Farmers� poultry meat manager Peta Easey says collective bargaining has been tried in other sectors but failed where farmers have only one buyer to deal with.

�It hasn�t worked in poultry meat,� she says. �Because there�s only a few processors, they know exactly what the others are doing. We welcome the ACCC�s commitment to further investigate the chicken meat industry. What�s needed is a mandatory code.�

The four ACCC recommendations

� Strengthen the business-to-business unfair contract terms framework in the ways agreed by the Legislative and Governance Forum on Consumer Affairs

� Introduce an economy-wide prohibition on unfair trading practices into Australian Consumer Law

� Strengthen the Food and Grocery Code, making it mandatory for retailers and wholesalers, and introducing significant penalties for contraventions

� Explore measures by governments and industries to increase price transparency and increase competition in perishable agricultural goods industries.

What do these terms mean?

Monopsony: a single buyer (e.g. supermarket or processor) substantially controls the market as the major purchaser from many would-be sellers (e.g. farmers)

Monopoly: a market with a single seller (e.g. supermarket) but many

buyers (e.g. consumers)

Oligopoly: a market or industry dominated by two or more large companies (e.g. supermarkets or processors)

Divesture/divestiture: the compulsory transfer of title or disposal of interests upon government order.

If you enjoyed this feature on the ACCC inquiry into perishables, you might like reading our story on the rice industry.