NSW Farmers has partnered with the Future Food Systems Cooperative Research Centre and the University…

The future of fuel: Is diesel here forever?

Diesel is the lifeblood of farming, but its availability is suddenly tied to a melting pot of factors. Supply chain disruption caused by COVID-19 and the war in Ukraine have sent diesel prices soaring, but these might be minor blips as the pressure to reach net zero emissions creates the possibility of a diesel-free future � causing many to wonder how agriculture will keep running on a full tank. What is the future of fuel?

Does diesel really need to go? The rise in diesel �alternatives� is showing the farmer�s preferred fuel doesn�t necessarily have to be dumped; it�s the fossil fuels used to create it that must go. The baby doesn�t need to be thrown out with the bathwater, so to speak, and the government and private sectors have been looking at diesel alternatives for years � producing a range of compelling options.

Diesel has a hold on the agriculture sector. About 80 per cent of production is reliant on it, and any changes to its price or availability are heavily felt by farmers.

According to John O�Connor, Research Officer at the Energy Efficiency Solutions Climate Branch at the NSW Department of Primary Industries, diesel is popular for a reason. It�s reliable, accessible, and easy to store. And John is adamant diesel engines don�t need to be abandoned any time soon. The fuel itself just needs to get cleaner.

�Diesel engines are not entirely the problem, and in fact they have come a long way over the past 20 years. The addiction farmers have to diesel isn�t necessarily a bad one.�

John O�Connor, Research Officer at the Energy Efficiency Solutions Climate Branch at the NSW Department of Primary Industries.

Is renewable diesel the answer?

There are ways of overcoming a reliance on fossil fuels to produce diesel, and renewable diesel is a frontrunning option � for the foreseeable future, at least.

Renewable diesel is an advanced biofuel made using renewable materials such as straw, biomass, sewage, vegetable oils, and animal fats. It can be used as a �drop-in� replacement for conventional diesel because it doesn�t require engine modification, can be blended, and can run in existing pipelines.

With the viability of renewable diesel having been demonstrated in the US, John O�Connor said its uptake here was more about an attitude shift.

�The supply of alternative fuels is still too small to be a replacement, but that will need to change over coming years,� he says, noting policy support and community awareness were key.

Biodiesel & hydrogen in the spotlight

Biodiesel is another low carbon option that uses oil and fats as feedstocks. Although it can already be blended with conventional diesel (typically at 5 per cent) biodiesel is not a complete replacement and therefore, according to John, �is not the full answer�.

Biodiesel is not always better for the environment than conventional diesel, either. The feedstock, farm practices, production process, energy source and distribution process all have a bearing on the carbon emitted � with varying outcomes.

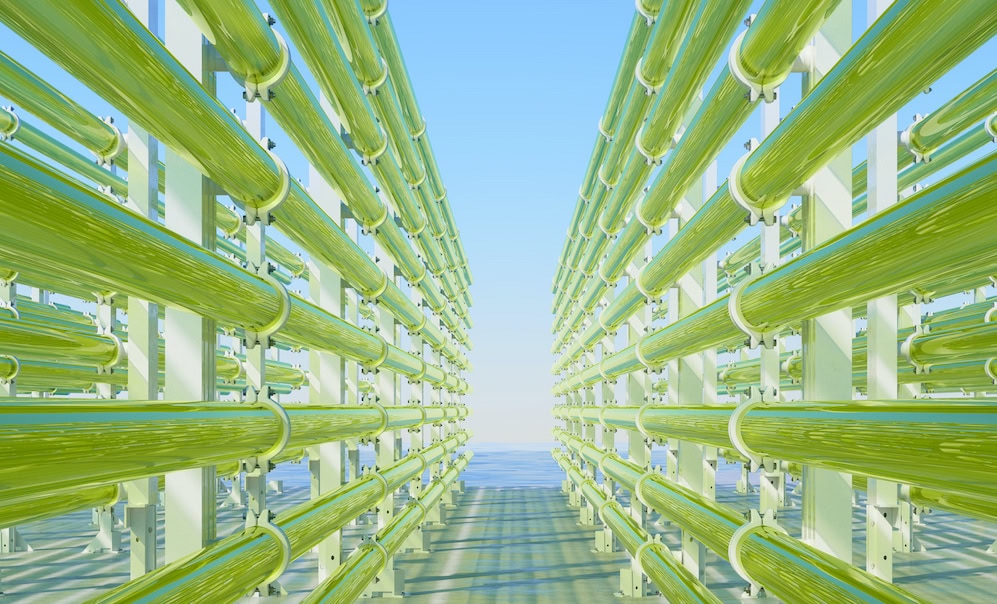

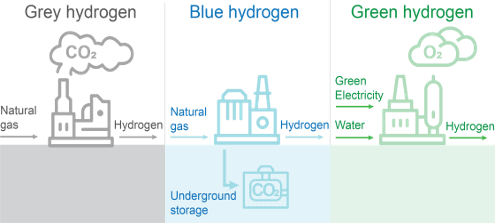

Hydrogen offers another low carbon fuel option, albeit a longer term one. Hydrogen is not a new energy source, but the processes used to create it can evolve to emit less or no carbon.

Dr Neil Thompson, an Adjunct Professor at the Queensland University of Technology and a farmer based near Kingaroy, said the first battlefront for hydrogen was transitioning away from so-called grey hydrogen � which uses natural gas � and toward green or possibly blue hydrogen.

Green hydrogen is produced using renewable electricity generated by the likes of wind turbines and solar panels to split water intro hydrogen and oxygen. Producing green hydrogen is carbon neutral, but the infrastructure needed to make it is expensive, unlike the much more common and carbon-emitting grey hydrogen. Blue hydrogen is made using the same process as grey hydrogen, but the carbon is captured and stored.

The carbon capture and storage (CCS) technology used to make blue hydrogen is the centrepiece of the federal government�s Technology Investment Roadmap to lowering emissions and was one of Australia�s key submissions to the 2021 Glasgow Climate Change Conference.

However the efficacy of CCS has been questioned by numerous experts, and according to Professor Thompson, was more expensive to produce than green hydrogen when additional storage costs and risk premiums were considered.

Green hydrogen is attracting growing interest from the commercial sector, with a potential $4 billion investment in the Hunter and Illawarra Hydrogen Hubs flagged by the NSW Government.

Treasurer and Energy Minister Matt Kean said commercial bids for these hubs included a plan to develop up to 5,900 megawatts of electrolyser capacity to produce green hydrogen. According to Minister Kean, the � market has spoken�, with green hydrogen expected to meet 24 per cent of global energy by 2050 and be worth an estimated $900 billion.

Farmers more heavily hit

NSW Farmers has been looking at the future of diesel for its members, and President James Jackson said agriculture couldn�t afford to be caught flat-footed on any changes to diesel use. However farmers don�t have the time or investment capacity to be finding greener solutions on their own.

�Agriculture as a sector is typically asked to carry a heavier load when it comes to meeting carbon reduction targets.�

NSWF President James Jackson.

�Suggestions that fuel tax credits be repurposed away from farmers� pockets and toward the exploration of low carbon options is frankly alarming when farmers shouldn�t be taxed for road use in the first place. And the tax credits are the only way they can recoup their losses.�

What about electric?

Electric vehicles are considered the primary driver of lower emissions in the transport sector, and the Australian Government�s plan for minimising transport emissions seemingly relies on subsidies and infrastructure to push EV use.

According to Nathan Gore-Brown, senior consultant at MOV3MENT, electric motors are much more efficient than combustion motors and some of the biggest advancements in vehicle energy efficiency have been made with some electric assistance.

�A lot of low- or no-carbon solutions � from diesel-electric hybrids, through battery electric solutions, to hydrogen fuel cells � rely on some degree of electrification using electric motors to replace or support diesel engines,� he says.

But many commentators agree that battery cells have limitations in agriculture.

John O�Connor says that the immense size and scale of agriculture in Australia meant battery cells were not yet fully viable. �We simply don�t yet have the infrastructure needed to go fully electric in Australia � especially in agriculture,� he says.

Professor Thompson said he wished he could buy an electric tractor for his farm, but the weight and duration limitations made it unfeasible.

�We saw electric ride on mowers developed in the US during the 1973 oil crisis so the current global oil price shock might expedite similar development of larger battery electric and hydrogen fuel cell electric tractors,� he says.

But while light trucks and machinery in peri-urban areas could feasibly go electric, John stresses the need to be realistic and to only electrify where practicable � not �just because�.

Moving to Methane

Methane is another avenue being explored, and recently New Holland released a methane tractor prototype. The world�s first 100 per cent methane powered production tractor which is said to provide a �virtuous cycle� whereby crop waste is used to power the tractor which helps grow those very crops.

But while methane�s potential has been showcased in Europe where smaller distances, intensive production, and favourable environmental laws make it viable, full-scale adoption in Australia�s agriculture sector is not likely.

What�s more, methane is a highly potent greenhouse gas and any leaks from the supply, distribution and use stages seriously impacts methane�s emission reduction potential.

Fuel security

Australia imports about 90 per cent of its liquid fuels, with only two oil refineries remaining in the country. The COVID-19 pandemic and the war in Ukraine revived discussions on Australia�s fuel security and sovereign fuel stocks, with diesel prices hiking as high as $3 per litre amid sanctions on Russia, the world�s second biggest exporter of crude oil.

John and Professor Thompson were both excited by the low- or no-carbon opportunities to shore up fuel supply if new biofuel refineries and electrolysis infrastructure are established in Australia.

Australia�s two remaining refineries � Viva Energy in Geelong and Ampol in Brisbane � have both publicly expressed a commitment to de-carbonisation, with the latter set to pilot a green hydrogen production plant. Professor Thompson says there is an opportunity for these refineries to differentiate themselves in the market with a greener product as they try to compete with overseas refineries.

�Building up local refineries would be huge for our food and even military security,� Professor Thompson said.

Australia currently has the capacity to produce enough biodiesel to constitute 4 per cent of agriculture�s fuel. But Australia�s only biodiesel refinery, Barnawartha, exports most of its fuel to more lucrative overseas markets.

Where to next for the future of fuel?

Diesel will still have a place in powering agriculture over the next 20 years. While the fuel itself will need to get cleaner, Nathan Gore-Brown said fuel efficient practices and electrification of equipment will also play a role in reducing carbon emissions.

Several commentators agree that the long game will involve replacing combustion engines with cleaner fuel cells. Hydrogen fuel cells, which are effectively electric vehicles with a hydrogen rather than battery energy storage system, are being touted as a key option.

The Renewables in Agriculture conference will see industry leaders converge in August this year � with diesel alternatives high on the agenda. Meanwhile, the NSW DPI�s Exploring Beyond Diesel events continue to look at low or no carbon fuel options under development.

If you enjoyed this feature on the future of fuel, you might like our story on innovations in ag.